“Partner in Wisconsin Multifamily Investments”

Disciplined value-add real estate with transparency, integrity, and strong returns for investors.

Why Invest With Emerald Crest

- Stable Cash Flow

Monthly/quarterly distributions backed by cash-flowing multifamily assets. - Equity Growth

Value-add renovations increase property value and investor equity. - Tax Advantages

Depreciation, cost segregation, and pass-through benefits.

Our Strategy

“Focused. Conservative. Value-Driven.”

- Target 24-75 unit Class B/C apartments in Class B markets.

- Strong underwriting with DSCR ≥ 1.25 and cap rate ≥ 8%.

- Heavy focus on hands-on renovations to unlock hidden value.

How It Works

- We Source & Underwrite – Conservative, data-driven deal analysis

- You Invest – Secure portal access and simple subscription process.

- Professional Management – Reputable, Experienced third-party property management oversees day-today operations, leasing, and tenant relations.

- We Oversee & Report – Emerald Crest provides strategic oversight, renovation management, and quarterly investor reporting.

- You Receive Returns – Quarterly distributions, annual K-1s, and long-term equity growth.

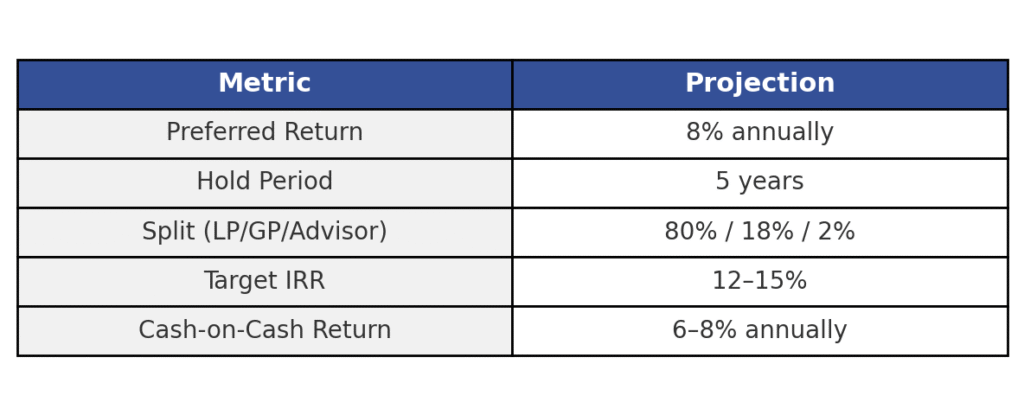

*Disclaimer: For illustrative purposes only, not a guarantee of performance.*

Alignment of Interests

- GP invested $10,000 of at-risk capital alongside LPS-Demonstrating personal commitment and shared risk.

- Reserves and conservative leverage built into every deal.

- Fees fully disclosed and aligned with investor success.

Transparency & Reporting

- Quarterly Updates – Financials, project photos, and performance metrics.

- Annual Tax Documents – K-1s delivered on time for smooth filing.

- Direct Access to GP – Investors receive the managing partner’s personal cell phone and email for anytime communication.

About the GP

The Managing Partner of Emerald Crest Holdings LLC brings a unique combination of technical expertise, operational leadership, and disciplined execution to multifamily real estate investing. With over a decade of experience in mechanical design, manufacturing, and team management, the GP applies a process-driven approach to acquisitions, renovations, and asset management that emphasizes risk mitigation and long-term value creation.

In addition to professional expertise, the GP has extensive hands-on experience overseeing residential remodels and investment property renovations. This background provides a practical understanding of construction workflows, budgets, and timelines—equipping the GP to evaluate bids accurately, manage contractors effectively, and identify value-add opportunities while minimizing risk. Having directly managed renovations that included framing, full bathroom remodels, basement conversions, roofing, carpentry, and finish work, the GP combines firsthand construction knowledge with the discipline of a structured investment framework.

Prior to founding Emerald Crest Holdings, the GP worked extensively in precision design and production environments, where success required attention to detail, rigorous documentation, and collaboration with cross-functional teams. These skills directly inform the company’s approach to underwriting, project oversight, and operational efficiency—ensuring investor capital is protected through disciplined execution.

The GP also brings a strong foundation in leadership, having supervised teams in production environments where efficiency, accountability, and coordination were critical to performance. This experience translates seamlessly into managing property operations, renovation projects, and third-party property management teams.

The Managing Partner leverages a background in design systems, operational processes, and data-driven decision making to support Emerald Crest Holdings’ commitment to delivering stable cash flow, disciplined growth, and long-term investor value.

Ready to Explore Passive Real Estate Investing?

This website is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities. Investments are offered only to accredited investors through official offering documents. Past performance is not indicative of future results.